I have often told landlord clients that the Chicago Residential Landlord Tenant Ordinance is simple in pieces and complex as a whole. There is no one provision of the ordinance that is unduly difficult to comply with. However, the law is packed full with tiny requirements and the penalty for noncompliance with tiny requirements is large. In July of 2010, the Chicago City Council amended the section of the CRLTO related to security deposits. Among the changes was a simple new requirement. Read about it after the break.

I have often told landlord clients that the Chicago Residential Landlord Tenant Ordinance is simple in pieces and complex as a whole. There is no one provision of the ordinance that is unduly difficult to comply with. However, the law is packed full with tiny requirements and the penalty for noncompliance with tiny requirements is large. In July of 2010, the Chicago City Council amended the section of the CRLTO related to security deposits. Among the changes was a simple new requirement. Read about it after the break.

The ordinance was amended to require that landlords holding a security deposit must disclose the name and address of the financial institution where a tenant’s security deposit is being held. As most Chicago landlords (who are aware of the CRLTO) know, the most common trouble from tenants results from the landlord’s improper care and handling of the security deposit.

Among the modifications to the law, effective August 28, 2010, was the creation of a new subsection of Section 080 of the CRLTO as follows:

(a)(3) The name and address of the financial institution where the security deposit will be deposited shall be clearly and conspicuously disclosed in the written rental agreement signed by the tenant. If no written rental agreement is provided, the landlord shall, within 14 days of receipt of the security deposit, notify the tenant in writing of the name and address of the financial institution where the security deposit was deposited.

If, during the pendency of the rental agreement, a security deposit is transferred from one financial institution to another, the landlord shall, within 14 days of such transfer, notify the tenant in writing of the name and address of the new financial institution.

Let’s break this down.

As my readers hopefully know, Section 5-12-080(a)(1) of the CRLTO requires landlords to hold all security deposits in a federally insured interest-bearing account in a bank, savings and loan association or other financial institution located in the State of Illinois that is not commingled with the landlord’s own assets and which remains the property of the tenant.

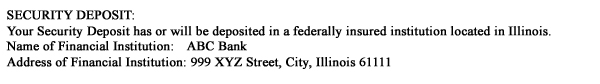

The new law supplements this obligation with a disclosure requirement. So, the CRLTO covered landlord is now obligated to disclose the (1) name and (2) address of the financial institution where the security deposit will be deposited. It is not necessary to include an account number.

The disclosure, if the rental agreement is written, needs to be “clearly and conspicuously” disclosed. To me, this means landlords would be smart to put the disclosure on the face of the lease agreement in large type.

The disclosure, if the rental agreement is written, needs to be “clearly and conspicuously” disclosed. To me, this means landlords would be smart to put the disclosure on the face of the lease agreement in large type.

The ordinance is quite specific that the disclosure must be made in the written rental agreement that is actually signed by the tenant. What if the disclosure is made on the security deposit receipt? That’s probably not good enough! The law requires the disclosure on the lease itself.

This leads into another interesting point. Far too many landlords keep messy, bad, or no records! Landlords cut down their liability risk by keeping clear and correct records. This means actually obtaining and storing for safekeeping a copy of the signed lease. If a landlord cannot produce a signed lease that includes the financial institution disclosure, that landlord could be in for trouble.

CRLTO covered Landlords who make an oral lease (not a good idea!) still have to provide a written notification to the tenant within 14 days after receipt of the security deposit.

Finally, if the landlord changes banks during the course of a lease, the landlord must notify the tenant in writing within 14 days after the transfer of the name and address of the new financial institution.

Simple, right?

So, what happens if a landlord fails to comply with this tiny little section of the ordinance? Just like all of the other requirements of Section 5-12-080, Section 5-12-080(f)(1) provides that if a landlord fails to comply, with 5-12-080(a)(3), the tenant shall be entitled to damages from the landlord equal to two times the security deposit plus interest. In addition, Section 5-12-180 will give the tenant the right to recover their attorney’s fees and costs.

So, for any lease executed in 2012, a landlord who forgets to disclosure the name and address of the financial institution where the security deposit will be held will be “on the hook” for double the deposit plus interest, attorney’s fees, and court costs. It is way less costly to comply!

Landlords looking for help with CRLTO lease compliance should feel free to give us a call to see if we are a match for an engagement. We regularly help landlords prepare leases that comply with the CRLTO and provide landlord counseling on best practices.

Counselor,

My mother owns a non-owner occupied Chicago 3-flat. Someone at the bank where she has her checking account told her that she could deposit the tenants’ security deposits in a money market account that has no deposits other than the security deposits.

Is this true?

I don’t know about the features of the particular account. However, the requirements for any security deposit account can be found at 5-12-080(a) as follows:

A landlord shall hold all security deposits received by him in a federally insured interest-bearing account in a bank, savings and loan association or other financial institution located in the State of Illinois. A security deposit and interest due thereon shall continue to be the property of the tenant making such deposit, shall not be commingled with the assets of the landlord, and shall not be subject to the claims of any creditor of the landlord or of the landlord’s successors in interest, including a foreclosing mortgagee or trustee in bankruptcy.

I didn’t follow many of the crlto reqs. I used a standard lease online and that was it. Now I want to evict. I convinced the tenant to sign a termination agreement. I am serving her a letter stating that she will be bound by a different lease if she decides to holdover. What lease will take precedence? Will I still be held to the old lease and the fines associated with it?

Kenn, without seeing the original lease and termination agreement, I can’t say which would have precedence. However, I can tell you that the statute of limitations for many of the CRLTO violations is either 2 or 5 years (depending on the violation) and that a landlord can be held liable for violations in previous leases even if those leases are not currently in force. You should obtain a consultation with an attorney soon to find out you rights and obligations!

Richard, I was just introduced to your blog and am loving it – thank you! I am a Chicago Realtor – my question with this is out-of-state Landlords. According to the Ordinance, the deposit must be in an account in a bank located in the State of Illinois. If a Landlord lives in California and has a Chase Bank account, would they be able to deposit the Security Deposit at a California Chase Branch and still be compliant with this section of the Ordinance because there are Chase Banks located in Illinois? Or do you feel the law requires the deposit to physically be deposited in Illinois? If the latter is the case, what do you recommend I tell my landlord’s that live out-of-state so that I protect them and also myself. Thank you!

Dave, that’s a great question. You are correct that the law says the account is to be within the State of Illinois. It also highlights the difficulty in applying the CRLTO to real live situations. The law is, frankly, poorly written. The courts have, time and again, held landlords to the strict letter of the law (for example, a letter sent on the 31st day is considered one day late and commingling of a security deposit, even if for only a second, is a violation).

So, could you hope that a judge views Chase bank in California as one and the same with Chase bank in Chicago? You could hope. However, you could also find yourself tested in court when a tenant and a tenant’s rights attorney challenge the concept. I don’t know of any case law on the issue.

To be safe, I advise my clients to actually set the account up in an Illinois branch of the bank. In fact, because the name and ADDRESS of the bank must to be disclosed, I want to make sure that my landlord client can give an Illinois address. I recognize that it is a pain to set the account up in Illinois rather than California, however, I don’t want my client to be the “test case” on the issue. A little hassle on the front end can prevent a bunch of legal fees (even if we win!) on the back end.

As for real estate agents, I think that they too should advise their clients to know and understand the CRLTO and to take a conservative approach to its application in order to avoid its harsh penalties. A real estate agent has a fiduciary duty to the client and should have a better knowledge of the CRLTO and CRLTO compliance than a lay-person. Advising the client to get some legal advice on these issues is never a bad idea either.

Hi Richard,

I am the landlord of a condo and want to know if there is a special type of account the security deposit should be held in. Is it OK to have a savings account in my name that only holds the security deposit or do I have to set up a client funds account similar to what an attorney would have?

Would it be a violation of the CRLTO to have the funds in a separate savings account in my name because the funds wouldn’t be free from the claims of a creditor?

Thank you.

Here is the actual law:

5-12-080 Security Deposits

(a)(1) A landlord shall hold all security deposits received by him in a federally insured interest-bearing account in a bank, savings and loan association or other financial institution located in the State of Illinois. A security deposit and interest due thereon shall continue to be the property of the tenant making such deposit, shall not be commingled with the assets of the landlord, and shall not be subject to the claims of any creditor of the landlord or of the landlord’s successors in interest, including a foreclosing mortgagee or trustee in bankruptcy.

So, as a landlord, you must put the deposit in an account that matches ALL of the following criteria:

1) the account must be federally insured;

2) the account must bear interest;

3) the institution holding the deposit must be a bank, savings and loan association or other financial institution;

4) the institution must be located within the State of Illinois;

5) the security deposit must not be commingled with the landlord’s other assets;

6) the security deposit shall not be subject to creditors’ claims.

So, any account that meets those criteria will work. I usually suggest to my landlord clients that they set the account up at a bank with a title like “John Smith, 222 W. Smith Street Security Deposit Account”. Most banks, even those in the City of Chicago, will not have a “special” account to be used by landlords, so landlords need to do their best to comply on their own.

Richard,

Great information, thank you.

If I have 20 tenants, how many bank accounts do I have to open?

If I originally was not aware (i know, the law says I am a “RE professional”, but still…) and did not deposit the security deposits to a separate accounts, but later rectified the problem and did that. But definitely not within 14 days. (within two months, to be precise) What are the probable consequences? They will still shoot me in the barrel?

…same with notifications…

Jerry, I removed your email and URL to protect the possibly guilty.

The same landlord can put all tenant security deposits into one account as long as NONE of the landlord’s money is commingled and the account meets all of the other requirements of 5-12-080 of the CRLTO.

Violations of 5-12-080 result in the imposition of a penalty in the amount of two times the security deposit. Not a small sum.

Richard, Thank you for answering the first part. What about the 2 months delay? Will I still be liable? Or the fact that I complied will earn me some forgiveness (in case there IS a case)?

I also have collected “last month rent” along with the original first month. Is it considered to be a security deposit as well and has to be treated as such?

Thank you for your kind reply.

It really depends on your facts. A landlord who takes a deposit that initial deposit and puts it in an account that does not comply or which is commingled for the first few months will be liable for a violation even if the landlord later corrects the situation. The fact that the problem is “fixed” does not change the fact that the violation occurred. In fact, there is case law that indicates that even if there is no harm to the tenant resulting from a commingling, the penalty still applies.

As for last month’s rent, considering that it is unearned and considering that 5-12-080 begins by reading “A landlord who holds a security deposit or prepaid rent pursuant to this section shall pay interest…”, I always counsel my clients that rent that is not earned by them and upon which they have an obligation to pay interest should also be handled like a security deposit.

Richard, Thank you for your valuable time to explain this one.

It is a pity that those who take financial risks, lots of responsibility, do something are treated like a cattle by the lawmakers, while those who live their lives renting can kick our butt just on a pure technicality. Very sad. Hope one day this idiotic situation changes as it is ridiculous in itself.

It just occurred to me. This situation will never change.

Banks rule the world (nothing new, right?)

They want people to bring the money and store this money. In the banks.

“Commingling” means that landlord might withdraw the money, put it back.

Bank want stability. If a renter lives there for 10 years, banks want to have money for 10 years paying just pennies of interest.

And noone has to touch it!

And it is the best when they can make it a law!

I honestly don’t think its the banks who are pushing this rule. I think the City’s goal here is to protect the tenant’s deposit. It is a consumer-protectionist law aimed at keeping a landlord from spending money that belongs to the tenant. And, they may even have a point.

Look at it this way. If a landlord takes a $1000 security deposit and puts it in the bank, separate and apart from the landlord’s own money, the deposit is conceivably safe from the landlord’s creditors, even in a bankruptcy. If the landlord takes the money and just puts it in the landlord’s own bank account, one of the landlord’s creditors could garnish the funds.

Then, when things “go bad” and the landlord goes under, the tenant is just another one of the landlord’s general creditors. I get that the City wants to protect tenants from landlords “going out of business”. The trouble with the law is really that good landlords or call them landlords who WANT to be good landlords can’t even get the opportunity to get straight on the law and do it right without being automatically subject to the 2x penalty. That’s a remedy that puts some major sting in the law.

Richard,

What is the best practice for returning a security deposit? Since it is a savings account, I won’t be able to write a check to the tenant.

For example, if I received $1,000 and deposited it into a security deposit savings account, can I write a check from the rental checking account and deposit the $1,000 from the security deposit savings account into the rental checking account, or does that raise a co-mingling issue?

Thanks!

I don’t think I would do it that way. If the money is in a savings account, I think I might take it out and have it turned into a cashier’s check or official bank check. I would not pay it from the general rental account as that would at least give rise to the suspicion that there is NOT a separate , segregated account in existence and could raise claims of co-mingling.

Richard,

Am I, the landlord, required to then pay the taxes on the interest that accrues in what basically ends up being a security deposit-only account?

Generally, yes. Luckily, the interest itself is usually only pennies or dollars.

Richard,

My landlord provided a security deposit receipt. However, the Bank of America address was not included on the receipt. The lease itself did not disclose where the security deposit would be held, nor the name of the bank. Would I be within my rights to demand the full return of my deposit?

We do not discuss tenant-related CRLTO cases on this page. You should contact a tenant’s rights attorney.