A pipe accidentally bursts in the closet wall of a rented apartment and a tenant’s property suffers major water damage. The tenant thinks the landlord is responsible and that the landlord’s insurance will cover the tenant’s damaged property. In most cases, the tenant is, unfortunately, mistaken. What kind of rules govern the insurance requirements of landlords and tenants? Many leases have provisions dealing with the insurance duties and obligations of landlords and tenants, but many do not. (By the way, all good leases should deal with the issue of insurance.)

A pipe accidentally bursts in the closet wall of a rented apartment and a tenant’s property suffers major water damage. The tenant thinks the landlord is responsible and that the landlord’s insurance will cover the tenant’s damaged property. In most cases, the tenant is, unfortunately, mistaken. What kind of rules govern the insurance requirements of landlords and tenants? Many leases have provisions dealing with the insurance duties and obligations of landlords and tenants, but many do not. (By the way, all good leases should deal with the issue of insurance.)

Landlords: Most landlord’s insurance policies cover only the landlord’s building and do not cover the tenant’s personal property. No Illinois law requires landlords to have insurance, (although any landlord without insurance is probably crazy). Illinois law does impose insurance disclosure requirements on certain landlords.

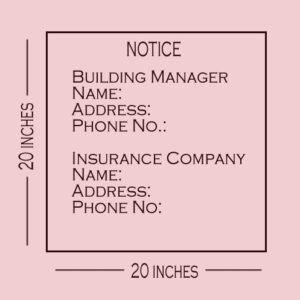

Curiously enough, the Illinois Forcible Entry and Detainer Act (at 735 ILCS 5/9‑320) requires that any landlord of residential real property containing more than 4 living units, who does not reside or maintain an office onsite and does not employ a manager or agent who resides or maintains an office onsite, shall post or cause to be posted on the property, adjacent to the mailboxes or within the interior of such residential real property in a location visible to all the residents, a notice of not less than 20 square inches in size bearing (i) the name, address and telephone number of the person responsible for managing the building; and (ii) the name, address and telephone number of the company or companies insuring such residential real property against loss or damage by fire or explosion or if the residential real property is not insured, that shall be stated in the notice.

If a landlord’s insurance is cancelled, the landlord must, within 24 hours, post a notice of such cancellation. A landlord may also provide the required information in a written lease or can provide the notice to the tenant via first class mail. A landlord’s failure to give the required notice shall subject the owner to pay a fine of not more than $100 per day of violation.

If a landlord’s insurance is cancelled, the landlord must, within 24 hours, post a notice of such cancellation. A landlord may also provide the required information in a written lease or can provide the notice to the tenant via first class mail. A landlord’s failure to give the required notice shall subject the owner to pay a fine of not more than $100 per day of violation.

Tenants: Unless a landlord is somehow negligent or responsible for the casualty that resulted in damage to a tenant’s personal property, a landlord’s policy will usually not cover the damage. Many tenants do not think about getting insurance on their personal property until it is too late. A “renter’s insurance policy” is not that expensive and can provide a tenant with peace of mind and possibly protect the tenant from other liability (such as if their dog bites someone or someone gets inured in the unit, as most renter’s insurance policies have general liability coverage as well). Tenants would be well advised to contact an insurance agent to discuss renter’s insurance (here’s a little plug for my father’s insurance agency, AFC Insurance Agency Ltd.)

Some landlords require their renters to provide renter’s insurance and to display proof of insurance prior to entering into a lease or allowing a tenant to take possession of a leased unit. Many condominium buildings impose similar requirements on tenants. Landlord’s need to be aware of association requirements and should decide up front whether or not they want to require insurance. If a landlord does not require insurance, it is always a good idea to remind the tenant that the landlord is not insuring the tenant’s property.

Landlords looking for help in drafting a lease with proper insurance provisions should feel free to contact me at 773-399-1122.

I am in Illinois. Is it illegal to have my landlord tell me by letter that if i don’t have renter’s insurance by a particular date AFTER the fact I had been living in the unit for sometime, that it is terms for termination of my lease?

I can’t answer your question directly because I have not had the opportunity to review your lease and tenancy situation. Generally, a landlord cannot impose a change in a lease mid-way through. More complex would be a situation where the lease required something that the landlord never enforced and maybe waived.

what kind of law is there in illinois on the property that has

less than 4 units.. (ie 2 multi units)?

Like most things with Illinois landlord tenant law, if there is no affirmative requirement, then the “common law” (ie. the law of landlord tenant as developed through published opinions and precedent in legal cases) and the lease will control. Keep in mind, every situation is different, so before acting, consult with an attorney to be sure of your rights and obligations.

Is the landlord required to have liability insurance in case of injury do to negligences?

735 ILCS 5/9‑320 indicates that the landlord must state that the property is not insured if that is the case. A landlord may be required by a lender to insure a premises, but there is no provision in law making “mandatory insurance” a requirement (such as the Illinois requirement that all drivers maintain automobile insurance). Insurance is always something smart to have, but is not required.

Is it mandatory in the state of Illinois to have rental insurance .

It is not required by state law, but a landlord can require it. Any tenant who goes without it is probably taking a big risk.